Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) to provide a global framework for how public companies prepare and disclose their financial statements. IFRS 1, specifically, deals with the first-time adoption of these standards.

The project for IFRS 1 was added to the IASB agenda in September 2001. The standard was issued in June 2003 and became effective for the first IFRS financial statements for a period beginning on or after 1 January 2004. Since then, it has been amended multiple times to clarify certain aspects and to accommodate new accounting considerations.

IFRS 1 sets out the procedures that an entity must follow when it adopts IFRSs for the first time as the basis for preparing its general-purpose financial statements. The standard aims to ensure that an entity’s first IFRS financial statements, and its interim financial reports within the first IFRS reporting year, contain high-quality information that is transparent for users and comparable over all periods presented. It also ensures that the financial statements are cost-effective to prepare and provide a suitable starting point for accounting under IFRS.

A first-time adopter is an entity that, for the first time, makes an explicit and unreserved statement that its general-purpose financial statements comply with IFRSs.

An entity may be a first-time adopter if, in the preceding year, it prepared IFRS financial statements for internal management use, as long as those IFRS financial statements were not made available to owners or external parties such as investors or creditors.

An entity can also be a first-time adopter if, in the preceding year, its financial statements:

IFRS 1 applies to entities that are presenting their first set of financial statements in compliance with IFRS, referred to as “first-time adopters.” This standard does not apply to entities that have already adopted IFRS or those that are merely considering the adoption of IFRS.

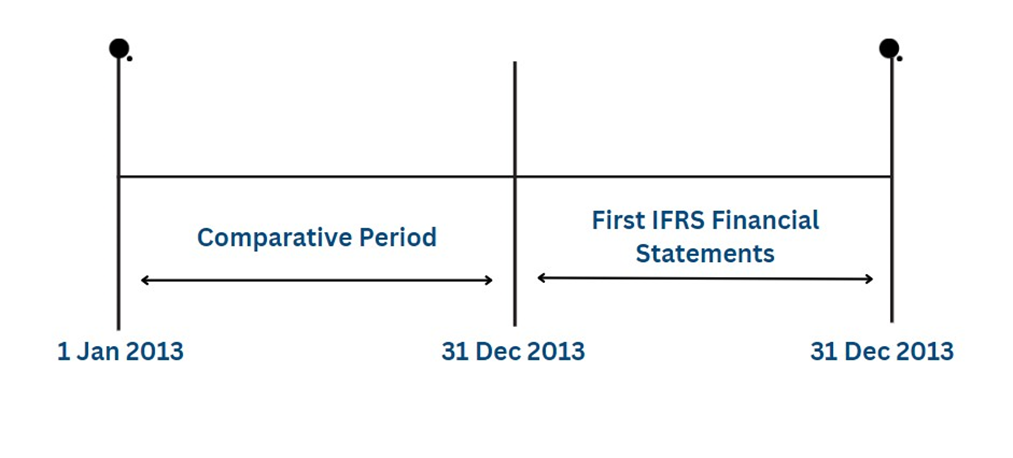

The first-time adopter must select a reporting date, which is the end of the reporting period covered by the entity’s first IFRS financial statements. This date is significant because it determines the starting point for applying IFRS, referred to as the “date of transition.”

The date of transition is the beginning of the earliest reporting period for which an entity presents full comparative information under IFRS in its first IFRS financial statements. This date is crucial as it is when the entity must start applying IFRS consistently and retrospectively.

IFRS 1 requires entities to apply IFRS retrospectively, which means that the entity needs to adjust its previously reported financial information to comply with IFRS. This involves restating the opening statement of financial position at the date of transition and adjusting the comparative financial information for the preceding periods.

Date of Transition = IFRS opening Statement of financial position Reporting Date

Hence as per above example we need to prepare at least 2014 and 2013 financial statements and the opening statement of financial position (as of 1 January2013 or beginning of the first period for which full comparative financial statements are presented, if earlier) by applying the IFRSs effective at 31 December 2014. [IFRS 1.7]

Since IAS 1 requires that at least one year of comparative prior period financial information be presented, the opening statement of financial position will be 1 January 2013 if not earlier. This would mean that an entity’s first financial statements should include at least: [IFRS 1.21]

If a 31 December 2014 adopter reports selected financial data (but not full financial statements) on an IFRS basis for periods prior to 2013, in addition to full financial statements for 2014 and 2013, that does not change the fact that its opening IFRS statement of financial position is as of 1 January 2013.

Transitioning from a previous GAAP (Generally Accepted Accounting Principles) to IFRS requires several adjustments. These include derecognition of some previous GAAP assets and liabilities, recognition of some assets and liabilities not recognised under previous GAAP, reclassification of previous-GAAP opening statement of financial position items into the appropriate IFRS classification, and measurement of all recognised assets and liabilities as per effective IFRSs.

Step Wise adjustments:

Step 1: Select accounting policies based on IFRS

Step 2: Derecognition of some previous GAAP assets and Liabilities: – Assets and liabilities that were recognized under the entity’s previous GAAP but do not meet the criteria for recognition under IFRS should be removed from the opening statement of financial position. For instance:

If the entity’s previous GAAP recognized certain expenditures, such as research start-up costs, pre-operating and pre-opening costs, training expenses, advertising and promotion costs, and moving and relocation expenses, as intangible assets under IAS 38, these should be eliminated in the opening IFRS statement of financial position.

Similarly, if the entity’s previous GAAP allowed the accrual of liabilities for items like “general reserves,” restructurings, future operating losses, or major overhauls that do not meet the conditions for recognition as a provision under IAS 37, these should be eliminated in the opening IFRS statement of financial position.

Additionally, if the entity’s previous GAAP permitted the recognition of contingent assets as defined in IAS 37.10, these should be eliminated in the opening IFRS statement of financial position.

The purpose of this elimination is to ensure that only assets and liabilities that meet the recognition criteria under IFRS are included in the entity’s financial position statement.

Step 3: Recognition of some assets and liabilities not recognised under previous GAAP: On the other hand, under IFRS, the entity should recognize all assets and liabilities that are required to be recognized, even if they were not previously recognized under the entity’s previous GAAP. This requirement is stated in IFRS 1.10(a). Here are some examples:

According to IAS 39, all derivative financial assets and liabilities, including embedded derivatives, must be recognized. These may not have been recognized under various local GAAPs.

Under IAS 19, an employer is required to recognize a liability when an employee has provided services in exchange for future benefits. This includes not only post-employment benefits such as pension plans but also obligations for medical and life insurance, vacations, termination benefits, and deferred compensation. In the case of ‘over-funded’ defined benefit plans, the surplus would be recognized as a plan asset.

IAS 37 requires the recognition of provisions as liabilities. Examples of provisions could include an entity’s obligations for restructurings, onerous contracts, decommissioning, remediation, site restoration, warranties, guarantees, and litigation.

Deferred tax assets and liabilities should be recognized in accordance with IAS 12, which governs income taxes.

In summary, under IFRS, the entity must recognize all assets and liabilities that meet the recognition criteria outlined in the respective IFRS standards, regardless of whether they were previously recognized under the entity’s previous GAAP. This ensures compliance with the comprehensive recognition requirements set forth in IFRS.

Step 4: Remeasurement of Financial Assets and Liabilities: Financial assets or liabilities classified as FVTPL are remeasured to fair value at each reporting date, with changes in fair value recognized in profit or loss.

Amortized cost: Financial assets held at amortized cost are typically remeasured by applying the effective interest method, which considers the initial recognition amount, transaction costs, and the effective interest rate. Any impairment losses are also recognized.

Step 5: Reclassification of Financial Assets and Liabilities: As per IFRS 1, when transitioning from previous GAAP to IFRS, the entity should reclassify items from the previous opening statement of financial position into the appropriate IFRS classifications. Here are some examples:

If the entity’s previous GAAP recognized dividends declared or proposed after the statement of financial position date as a liability, IFRS 1 requires the reversal of this liability in the opening IFRS statement of financial position, as dividends are not classified as liabilities under IAS 10.

In cases where the entity’s previous GAAP allowed treasury stock (shares repurchased by the entity) to be reported as an asset, IFRS 1 mandates the reclassification of treasury stock as a component of equity under IFRS.

Identifiable intangible assets classified under previous GAAP in a business combination may need to be reclassified as goodwill under IFRS 3 if they do not meet the definition of an intangible asset according to IAS 38. However, the opposite may also occur in certain situations.

According to IAS 32, items must be classified as either financial liabilities or equity. Thus, mandatorily redeemable preferred shares that were classified as equity under previous GAAP would be reclassified as liabilities in the opening IFRS statement of financial position.

It’s important to note that IFRS 1 provides an exception to the “split-accounting” provisions of IAS 32. If the liability component of a compound financial instrument is no longer outstanding at the date of the opening IFRS statement of financial position, the entity is not required to reclassify the original equity component out of retained earnings and into other equity.

The reclassification principle also applies to defining reportable segments under IFRS 8. Some offsetting (netting) of assets and liabilities or income and expense items that were acceptable under previous GAAP may no longer be acceptable under IFRS.

In summary, under IFRS 1, the entity is required to reclassify items from the previous opening statement of financial position into the appropriate IFRS classifications, ensuring consistency with the classification principles outlined in the relevant IFRS standards.

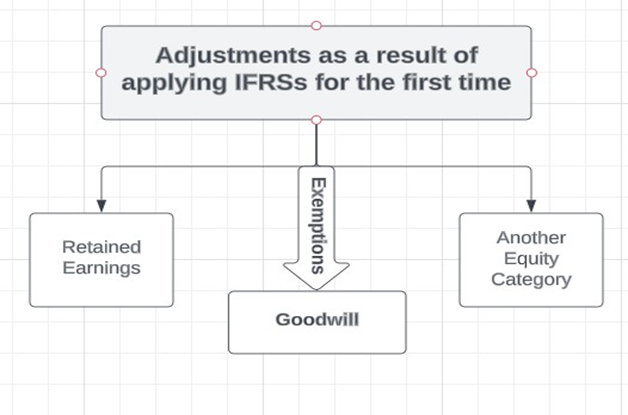

Any necessary adjustments made to align financial statements from previous GAAP to IFRS should be reflected as direct changes to retained earnings or, if suitable, another equity category at the date when the transition to IFRS occurs.

This ensures that the impact of the transition adjustments is appropriately captured within the entity’s accumulated earnings or other equity components as of the transition date.

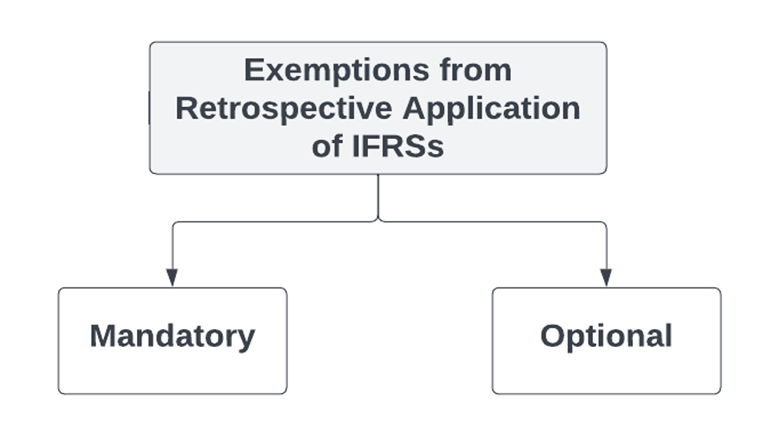

Before the start of 2010, there were three variances to the overarching rule of retrospective application. On the 23rd of July 2009, IFRS 1 was revised, and these changes came into effect on 1st January 2010. The amendments introduced two more exceptions to simplify the transition process for first-time IFRS adopters. There are some exceptions to the general principle of retrospective application. These exceptions relate to derecognition of financial instruments, hedge accounting, non-controlling interest, full-cost oil and gas assets, and determining whether an arrangement contains a lease.

First-time adopters should apply the derecognition rules in IAS 39 moving forward for all transactions that happened after 1st January 2004. The rules may, however, be applied retrospectively if the necessary information was obtained during the initial accounting for those transactions [IFRS 1.B2-3].

The standard stipulates that a company’s opening IFRS financial statement should not reflect a hedging relationship that doesn’t qualify for hedge accounting as per IAS 39. If an entity, under the previous GAAP, designated a net position as a hedged item, it may designate an individual item within that net position as a hedged item under IFRS, provided it does so by the transition date to IFRS [IFRS 1.B5].

Note: Altered requirements are applicable when an entity applies IFRS 9 Financial Instruments (2013).

Specific IFRS 10 Consolidated Financial Statements requirements are to be applied moving forward as outlined in IFRS 1.B7.

Entities using the full-cost method can choose to be exempt from retrospective application of IFRSs for oil and gas assets. Entities opting for this exemption will use the carrying amount under their old GAAP as the deemed cost of their oil and gas assets at the date of initial IFRS adoption.

In a scenario where a first-time adopter with a lease agreement has already made a determination (in line with the previous GAAP) about whether an arrangement contains a lease as required by IFRIC 4, but at a different date than the one prescribed by IFRIC 4, the amendments excuse the entity from having to apply IFRIC 4 upon transitioning to IFRSs.

IFRS 1 provides some optional exemptions to the general restatement and measurement principles. These following exceptions can be individually chosen and pertain to:

business combinations, transactions involving share-based payments, insurance contracts, leases, cumulative translation differences, investments in subsidiaries, jointly controlled entities, associates and joint ventures, assets and liabilities of subsidiaries, associated and joint ventures, compound financial instruments, financial assets or financial liabilities at initial recognition, decommissioning liabilities included in the cost of property, plant, and equipment, financial assets or intangible assets accounted for in accordance with IFRIC 12 Service Concession Arrangements, borrowing costs, transfers of assets from customers, extinguishing financial liabilities with equity instruments, severe hyperinflation, joint arrangements, and stripping costs in the production phase of a surface mine.

A few, but not all, of these are elaborated below.

IFRS 1 provides Appendix C, which outlines how a first-time adopter should manage business combinations that took place prior to the transition to IFRS.

An entity can opt to maintain the original GAAP accounting and not restate:

Earlier mergers or goodwill subtracted from reserves, the carrying amounts of assets and liabilities recognized at the acquisition or merger date, or how goodwill was initially determined (no adjustments to the acquisition price allocation).

However, an entity can choose to restate all business combinations from a chosen date before the opening statement of financial position date.

In all situations, the entity must perform an initial IAS 36 impairment test on any remaining goodwill in the opening IFRS statement of financial position, after appropriately reclassifying GAAP intangibles to goodwill.

The exemption for business combinations also applies to acquisitions of investments in associates, interests in joint ventures, and interests in a joint operation when the operation constitutes a business.

Assets carried at cost (like property, plant, and equipment) may be valued at their fair value at the transition date to IFRSs. This fair value becomes the ‘deemed cost’ under the IFRS cost model. Deemed cost is a substitute for cost or depreciated cost at a particular date [IFRS 1.D6].

If, before the first IFRS statement of financial position date, the entity had revalued any of these assets under its previous GAAP either to fair value or to a price-index-adjusted cost, that revalued amount can become the deemed cost of the asset under IFRS [IFRS 1.D6].

If, before the first IFRS statement of financial position date, the entity had performed a one-time revaluation of assets or liabilities to fair value due to a privatisation or initial public offering, and the revalued amount became deemed cost under the previous GAAP, that amount would continue to be deemed cost after the initial adoption of IFRS [IFRS 1.D8].

This option is only applicable to intangible assets if an active market exists [IFRS 1.D7].

If the carrying amount of property, plant and equipment or intangible assets that are used in rate-regulated activities includes amounts under previous GAAP that do not qualify for capitalisation in accordance with IFRSs, a first-time adopter may choose to use the previous GAAP carrying amount of such items as deemed cost on the initial adoption of IFRSs [IFRS 1.D8B].

Entities subject to rate-regulation can also optionally apply IFRS 14 Regulatory Deferral Accounts upon transitioning to IFRSs.

An entity can choose to recognize all cumulative actuarial gains and losses for all defined benefit plans at the opening IFRS statement of financial position date (that is, reset any corridor recognized under previous GAAP to zero), even if it chooses to use the IAS 19 corridor approach for actuarial gains and losses that arise after the first-time adoption of IFRS. If a first-time adopter uses this exemption, it must apply it to all plans [IFRS 1.D10].

Note: This exemption is not available when IAS 19 Employee Benefits (2011) is applied, which is effective for annual reporting periods beginning on or after 1 January 2013.

An entity can choose to recognize all translation adjustments arising from the translation of the financial statements of foreign entities in accumulated profits or losses at the opening IFRS statement of financial position date (that is, reset the translation reserve included in equity under previous GAAP to zero). If the entity chooses this exemption, the gain or loss on subsequent disposal of the foreign entity will only be adjusted by those accumulated translation adjustments arising after the opening IFRS statement of financial position date [IFRS 1.D13].

In May 2008, the IASB revised the standard to modify how the cost of an investment in the separate financial statements is measured on the first-time adoption of IFRSs. The amendments to IFRS 1:

Permit first-time adopters to use a ‘deemed cost’ of either fair value or the carrying amount under previous accounting practice to measure the initial cost of investments in subsidiaries, jointly controlled entities and associates in the separate financial statements, remove the definition of the cost method from IAS 27 and add a requirement to present dividends as income in the separate financial statements of the investor, and require that, when a new parent is formed in a reorganization, the new parent must measure the cost of its investment in the previous parent at the carrying amount of its share of the equity items of the previous parent at the date of the reorganization.

If a subsidiary becomes a first-time adopter later than its parent, IFRS 1 permits a choice between two measurement bases in the subsidiary’s separate financial statements. In this case, a subsidiary should measure its assets and liabilities as either [IFRS 1.D16]:

The carrying amount that would be included in the parent’s consolidated financial statements, based on the parent’s date of transition to IFRSs, if no adjustments were made for consolidation procedures and for the effects of the business combination in which the parent acquired the subsidiary or the carrying amounts required by IFRS 1 based on the subsidiary’s date of transition to IFRSs.

A similar choice is available to an associate or joint venture that becomes a first-time adopter later than an entity that has significant influence or joint control over it [IFRS 1.D16].

If a parent becomes a first-time adopter later than its subsidiary, the parent should, in its consolidated financial statements, measure the assets and liabilities of the subsidiary at the same carrying amount as in the separate financial statements of the subsidiary, after adjusting for consolidation adjustments and for the effects of the business combination in which the parent acquired the subsidiary. The same approach applies to associates and joint ventures [IFRS 1.D17].

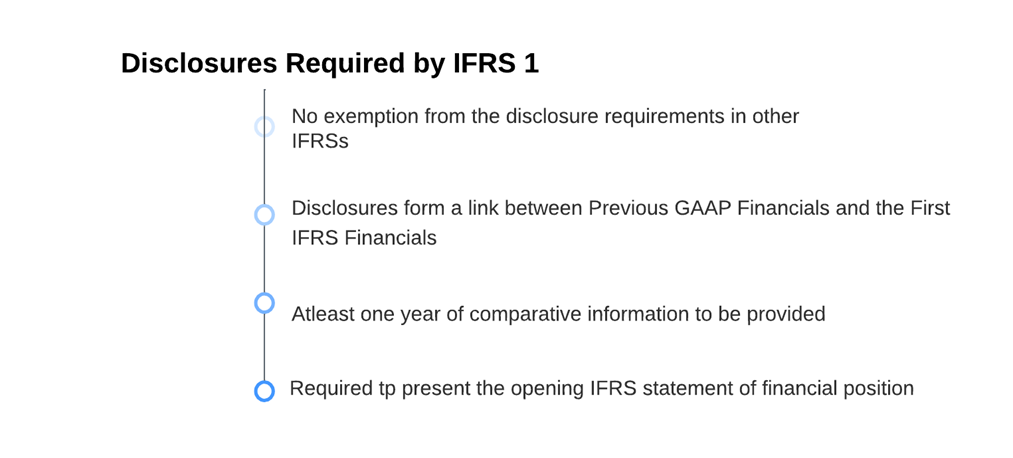

IFRS 1 requires disclosures that explain how the transition from previous GAAP to IFRS affected the entity’s reported financial position, financial performance, and cash flows. This includes reconciliations of equity reported under previous GAAP to equity under IFRS and reconciliations of total comprehensive income for the last annual period reported under the previous GAAP to total comprehensive income under IFRSs for the same period.

Selection of Pre-IFRS Financial Data Disclosure

A first-time IFRS adopter is not required to convert its financial data of preceding periods to comply with IFRS if it chooses to disclose selected financial information. The alignment of such historical financial data with IFRS standards is optional. [IFRS 1.22]

Should the entity opt to display this past financial information under its previous GAAP rather than conform to IFRS, it must ensure that the data is clearly marked as non-compliant with IFRS. In addition, it must disclose the primary adjustments necessary to make the information IFRS compliant. The disclosure should outline the changes, though it does not need to be quantified. [IFRS 1.22]

Mandatory Disclosures for First-Time IFRS Adopters

IFRS 1 stipulates disclosures to illustrate how the transition from the previous GAAP to IFRS has impacted the entity’s reported financial position, financial performance, and cash flows. [IFRS 1.23] This includes:

Reconciliations of equity reported under previous GAAP to equity under IFRS at both (a) the transition date to IFRS and (b) the end of the last annual period reported under the previous GAAP. [IFRS 1.24(a)] (For an entity adopting IFRS for the first time in its 31 December 2014 financial statements, the reconciliations would pertain to 1 January 2013 and 31 December 2013.) Reconciliations of total comprehensive income for the last annual period reported under the previous GAAP to total comprehensive income under IFRS for the same period [IFRS 1.24(b)] Explanations of significant adjustments made when adopting IFRS for the first time to the financial position statement, comprehensive income statement, and cash flow statement (if presented under the previous GAAP) [IFRS 1.25] Separate disclosure of any errors in previous GAAP financial statements found during the transition to IFRS [IFRS 1.26] Disclosure of any recognised or reversed impairment losses while preparing the opening IFRS statement of financial position [IFRS 1.24(c)] Detailed explanations if the entity chooses to apply any specific recognition and measurement exemptions allowed under IFRS 1 – for example, using fair values as deemed cost.

Interim Financial Reports Disclosures

If an entity plans to adopt IFRS for the first time in its annual financial statements for the year ending 31 December 2014, certain disclosures are mandated in its interim financial statements prior to the 31 December 2014 statements. However, this applies only if these interim financial statements claim to comply with IAS 34 Interim Financial Reporting. The interim report, which immediately precedes the first IFRS annual financial statements, must contain explanatory information and a reconciliation. This includes reconciliations between IFRS and the previous GAAP. [IFRS 1.32]

In conclusion, IFRS 1 provides a comprehensive guide for entities adopting IFRS for the first time. It ensures that the transition is smooth, transparent, and provides high-quality, comparable information for all periods presented.